I didn’t think I would start a home bakery in Maryland when the New Year rolled around. But, life has a way of surprising you, even if you feel like you’re starting over in your 30s.

The information provided in this blog post is for general informational purposes only. I am not a legal or tax expert, and the content here should not be construed as legal, tax, or financial advice.

While I strive to ensure accuracy, please consult with a qualified legal or tax professional, or relevant authorities, for advice specific to your situation, especially regarding home baking, cottage food laws, taxes, and any business regulations.

This blog post may include affiliate links, which means I may earn a commission if you make a purchase through these links, at no additional cost to you.

Your trust is invaluable to me, and I only recommend products that I genuinely believe will benefit you and would personally buy or have bought myself! Whether or not I earn a commission, these are products I would still recommend. With your support, I’m able to provide you with free information on my blog that is helpful to you.

Why I started a home bakery in Maryland

I baked from time to time in high school, but I really got into baking in college!

I would host friends for dinner and always prepared dessert. When I wasn’t hosting, I would bake and saran wrap individual portions to give out to friends on campus.

A good friend of mine that I’m still in contact with today was always flabbergasted by the fact that I would just pull out muffins from my bag 😂😂😂

Granted, I baked mostly because I wanted to eat what I made — first and foremost. I’m not that nice LOL

The problem was (and still is) that most, if not all, recipes feed about 6-8 people and I didn’t know how to convert my favorite baking recipes into different pan sizes yet.

Anyway, flash forward to Christmas 2023, I decided to bake cookies for the close friends I made that year, mostly from my MMA gym, and before you knew it, non-rumors circulated about my affinity for baking.

The following May, I was out for an injury and one of my jiu-jitsu instructors reached out asking how I was and when I was going to post more cookie content to my stories!

Funnily enough, I baked cookies for my cousins that very day.

Refusing just to take what was left over, he insisted on paying for them and encouraged me to make it a business.

And I did with Cookie Cazimi because I gave up on life (not really) and I stopped taking myself seriously.

What does Maryland consider to be cottage food?

One of the first things I did after I decided to start a home bakery in Maryland was to look into what I’m able to sell from my residential kitchen in my home state.

The Maryland Department of Health (MDH) outlines what foods are allowed for cottage food businesses.

So, don’t think you have to wing it and just hope you don’t get in trouble!

Please note that I’m mainly going over and focusing on what stood out to me as someone who primarily sells chunky New York City-style cookies in the Guideline for Cottage Food Businesses — I highly recommend bookmarking this resource by the way.

If you want to sell other items, by all means, do so! Hopefully what I go over will still answer some of your questions regardless.

Anyway, the State of Maryland defines cottage food as “non-potentially hazardous/non-perishable” meaning the food item must have a low water activity and/or a low pH (aka be acidic) in order to be “stored under normal conditions without refrigeration.”

Examples of allowable foods are listed. You can make baked breads, cookies, pastries, hot-filled canned acid foods, and non-potentially hazardous candy to name a few.

And they use the word “allowable” rather than “allowed” because this is a guideline, not a strict rulebook. You could make something that totally falls within the stated definition but they just didn’t list it!

But, of course, the devil is in the details and I have some more background information to share on what foods you are allowed to make and sell for your home bakery in Maryland.

What is not allowed under cottage food law in Maryland?

The Maryland Department of Health writes that “baked goods that require any type of refrigeration” cannot be allowed as cottage food.

The MDH also lists the “potentially hazardous topping or fillings” you can’t include either. So, delicious custards, meringues, or buttercreams using cream, cheese, cream cheese (lol), and fruit curds are not allowed because these all need to be refrigerated!

They also explicitly tell you that you aren’t allowed to use vegetables, meats, fish, etc. but if you’re thinking about starting a home bakery in Maryland, it’s like, “duh…”

But, of course, we must cover all our bases.

Oh, you also can’t make chocolate, meaning taking a freakin’ cacao bean and doing who knows what to make it into chocolate. I don’t why the hell you’d want to do that, but you can’t.

You can, of course, use commercially made and available chocolate like a normal person.

What kind of fruit can I use for my cottage home bakery in Maryland?

Previously, I said water activity and pH determine whether a food item can be stored at room temperature, so how is fruit allowed since there’s typically a lot of water in fruit?

It’s the pH! You’re allowed to use acidic or high-acid foods with a naturally low pH of 4.6 or less.

Some fruits that are considered highly acidic are apricots, apples, blueberries, citruses, cranberries, pineapples, pomegranates, raspberries, and strawberries.

And, that’s also why foods like bananas, pumpkin, and zucchini are not allowed to be used in your baked goods.

You can still make a mean lemon loaf though!

This is a bit of a sidebar, but if you want to make a glaze for the lemon loaf, be sure to only use lemon juice and not water because water will make it susceptible to bacterial growth (because we’re increasing the water activity) whereas lemon juice is too acidic to let things grow even if there technically is water in it.

Personally, I like to use commercially freeze-dried versions of these fruits (minus the citrus) in my baked goods because the moisture from my cookie dough will give them a wonderfully chewy texture.

You still have to use high-acid fruits so freeze-dried bananas or mangoes are not allowed because they’ll be slightly reconstituted after baking and won’t have the correct pH (in theory, but I did confirm this information with the MDH as well).

I also like to use citrus-flavored extracts or emulsions because fruit is expensive! And I can’t buy a million lemons just for the zest… because I don’t sell glazed lemon loaves… I was just letting you know you could do that in the state of Maryland lol.

What commercially made foods does Maryland allow in cottage baking?

Yes! You are allowed to use commercially manufactured food items as long as they don’t need to be refrigerated after opening.

So, while you can’t make, use, or sell your own caramels or marshmallows or foods using them without testing, you can use commercially available caramels and marshmallows that can be found in the aisle section of any grocery store that don’t need to be refrigerated after opening.

I love using chocolate stuffed with creamy caramel as a filling for my NY cookies!

This also applies to commercial peanut butter, chocolate hazelnut spread, cookie butter, and pistachio butter/cream as long as the instructions or company tells you to store at room temperature.

Are there any exceptions as to what I can sell as cottage food for my home bakery in Maryland?

Remember, the Guideline from MDH said that low water activity and/or low pH determine whether a food can be “stored under normal conditions without refrigeration” and if it can, it is considered a cottage food.

Well, if you can prove this cheesecake has a water activity of 0.85 or less, a pH of 4.6 or less, or both then you are able to sell that product as a cottage food business in the state of Maryland.

Cheesecake is a bit of a stretch, but you get what I mean.

If you can prove it, you can use it!

You don’t have to send anything in. Just have them ready to show when asked.

And while I’ve never sent anything out for food laboratory testing yet, I have heard good things about the University of Arizona and Midwest Laboratories.

How to package and label cottage foods in Maryland?

The Guideline for Cottage Food Businesses states that “[a]llowable foods produced under the cottage foods regulation must be prepackaged at the cottage food business and labeled…”

So, I can’t just have my NYC cookies out in a case and put them in a little baggie like that coffee chain we all think of when we think of coffee chains lol.

I package my cottage baked goods in cellophane cookie bags and use printable stickers for my labels.

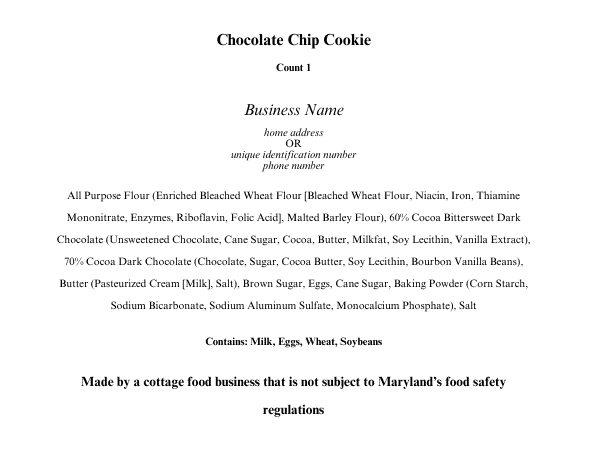

In regards to how to label your cottage foods in Maryland, you have to include the following:

- Business name

- Residential home address you’re baking out of

- Name of the cottage food product

- Ingredients (and sub-ingredients) in descending order of the amount of each ingredient by weight

- Net weight, count, or net volume of the cottage food product. I personally use “Count 1” for my cookies because if you go by net weight or net volume, you will have to be exact.

- Allergen information as specified by federal labeling requirements. If any health or nutritional information claim is made, you will also need to include nutritional information as specified by federal labeling requirements

- The statement, “Made by a cottage food business that is not subject to Maryland’s food safety regulations” in a 10-point or larger font size in a color that provides a clear contrast to the background of the label

Do I have to put my home address on cottage food labels?

Yes, but you can replace it by applying for a unique identification number from the Maryland Department of Health.

Go to the Cottage Food Business Request page and follow the instructions.

This process can take up to twelve (12) weeks. Although your experience may vary, I received mine in about a month.

What if I still have questions about what I can do as a cottage food business in Maryland?

The State of Maryland has an FAQ page answering the most common questions regarding Maryland cottage food businesses.

You can also email the MDH Food Plan Review at mdh.foodplanreview@maryland.gov for more clarity on your specific questions if you don’t find the answer you’re looking for. I reach out to them all the time for clarification.

Shout out to Ashley!

Do I need an LLC to operate a home bakery in Maryland?

No, you do not need to file for a Limited Liability Company (LLC) to operate a home bakery in Maryland.

You can make money as a sole proprietor and file for one (or any other business structure) later down the line.

Personally, I did hire Northwest Registered Agent to file a Limited Liability Company for my cottage food business (and this blog).

Do you need to open a business bank account?

I’m not a tax professional nor do I do my own taxes, so I can only tell you what I did and what I was advised for my particular case.

My tax lady advised that I open a business bank account pretty much as soon as I make money, which was right away since I started with the encouragement of my friends.

She told me that we would file a Schedule C since I am the only one running my LLC.

I also want to mention that the bank I work with also requires an LLC to open a business bank account. I think if I hadn’t decided to file for an LLC right away, I would have asked my tax person about opening another checking account to strictly do business out of so my personal finances didn’t mix, but this is completely a hypothetical of what I would have done and not legal advice!!

What about sales tax?

Maryland Taxes has a list of what you need to charge sales tax on. As of writing this blog post, the sales tax rate in Maryland is 6%.

For myself, I do not have to charge sales tax on the baked goods I sell.

Do I need food liability insurance to run a cottage food bakery?

You don’t really need anything beyond following the guidelines for cottage foods, but I highly recommend getting food liability insurance lol. I use FLIP.

It is commonly misunderstood that an LLC will protect your personal assets even if you’re found liable for injury from your cottage food products. But, I don’t believe so.

Again, not a lawyer and this is not legal advice.

But, I’ve been told that if you only have an LLC and don’t have food liability insurance, you would still be financially responsible for legal claims or settlements even if your business is bankrupt. You would still be on the hook.

Concluding how to start a home bakery in Maryland

And that’s everything I know so far about starting a home bakery in Maryland that complies with the state’s cottage food laws.

I can’t wait to share more about my experience as a farmer’s market vendor with you all very soon!

NEED RECIPES?

Check out the Recipe Library to see what other bakes you can make in over 25 baking pan sizes!